Introduction

Students who aim to pursue their higher education abroad have to clear two main hurdles- firstly, pull out all the stops to make it through the college admissions, and arrange funds to finance their sky-high tuition fees. Students may seek an education loan to support the cost of study overseas. Depending on this, the first thought which would spring in the applicant’s mind is- what is the requirement, eligibility criteria, interest rate, sanction time etc. If you are going through the same, read this article till the end. This article aims to give clear insights on education loans for study abroad and how Vidyalaons will help you get an education loan in India for your studies abroad.

Types of student loan for study abroad

There are basically two types of overseas education loan:

- Secured or collateralized loans

Secured loans are also known as collateralized loans as the borrower is required to pledge a security in order to avail an education loan for study abroad. For eg: House, flat, lands with defined boundaries, Fixed deposits etc. - Unsecured or non-collateralized loans

Unsecured loans are also known as non-collateralized loans as the borrower is not obligated to pledge any collateral to avail an education loan but the borrower has to meet the eligibility criteria to avail an education loan.

Student loan for study abroad-Expenses Covered

- Tuition and course fee

- Living expenses

- Food expenses

- Travel expenses

- Cost of books,equipment or any other study material

- Examination/ Library Fees/ Laboratory Fees

- Any other expenses required to complete the coursework

Eligibility for education loan for study abroad

Students who have applied for an education loan or are willing to take a loan must envisage the eligibility criteria and should qualify for the same. Eligibility criteria may differ from bank to bank. However, few common criteria set by the financial institutions are:

- The age of student must fall in the bracket of 18-35

- The student must be a resident of India

- The student must opt for a UG program/ PG program/ PG Diploma course

- The student must have a confirmed admission letter

- The student must possess admission to any professional or technical course in a recognized university and should be affiliated by UGC/AICTE/Government etc.

- Students willing to pursue full-time courses need to have a co-applicant (parent/guardian or spouse/parent-in-law/ siblings/ first cousins)

Eligible Courses for Education Loan for abroad

One of the prime eligibility conditions for most of the banks is the course/program a student opts for. A wide range of courses is applicable while taking an education loan for study abroad. A student must pursue a course which leads to future employment or income generation. These courses can either be STEM courses (Science, Technology, Engineering, Mathematics) or Non-STEM courses like Public Policy, Aviation, etc. Read this article to know all the courses eligible for an education loan.

What are all documents required for applying for an Education Loan for Study Abroad?

Basic Documents

- Duly filled and signed application form with affixed photographs

- Copy of exam mark sheets of 10th/12th or latest education certificate

- Statement of course expenses/cost of study

- 2 photographs of passport size

- Aadhaar Card and Pan Card of the Student and Parent/ Guardian

- Copy of Aadhaar Card /Voter ID/Passport/Driving License

- Identity proof

- Age proof

- Copy of Voter ID/Aadhaar Card/Driving License/Passport

- Residence proof

- Rental agreement/Bank statement of 6 months of the student or co-borrower/guarantor/Copy of Ration card/Gas Book/Electricity Bill/Telephone Bill

Income proof

- Most recent salary slips or Form 16 of the parent/ guardian/co-borrower

- 6 months bank statement of the borrower or updated passbook of bank

- Updated ITR (Income Tax Return with income computation) of 2 years or IT assessment order of last 2 years of parent/co-borrower/guardian

- Documents stating the assets and liabilities of the parent/ co-borrower/ guardian

Basic Property related documents

- Property title deed

- Registered Sale Agreement or gift deed or will papers, followed by the original receipt of the same

- Allotment Letter by Municipal Corporation (MHADA/CIDCO/HUDA/DDA/JDA)

- 30 years link document of the property previous chain of the sale deed

- The latest property tax bill and latest electricity bill with the same address

- Copy of municipality approved building plan or plot layout

There are other few mandated documents set by the banks which are demanded on an immediate basis. Failure to provide the documents on time may lead to rejection of loan application. Therefore, it is suggested to connect with our team at Vidyaloans. Our processing officers will update you with the latest checklist and the state-specific required documents also.

Note: VidyaLoans is an organization which helps Indian students to secure a non-collateral loan from Government banks up to 10 Lakhs for abroad studies. To connect with our team, fill the education loan application form with all the required details and our team will reach you soon.

What will Improve Your Eligibility to avail a study loan for abroad?

Banks follow strict guidelines while assessing the profile of the candidate. Few parameters which will help you improve your overseas education loan eligibility are:

- Scoring high grades and ranking in the qualifying exams

- Maintain decent academic record (above 60% marks)

- Get an admission letter from bonafide educational institution (reputed/top-tier institute)

- Strong financial background of parents/guardians/co-borrower

- Display good prospects for future employment/income generation

- Maintain and build good CIBIL score (above 700)

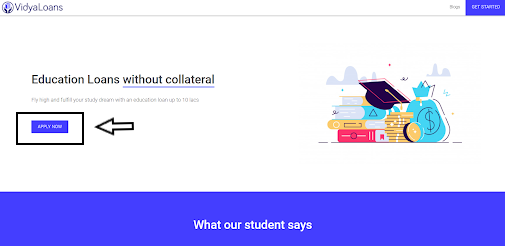

How to apply for an education loan for study abroad through VidyaLoans?

Step 1: Visit the official website of VidyaLoans ( https://www.vidyaloans.com/ )

Step 2: Click on the apply button

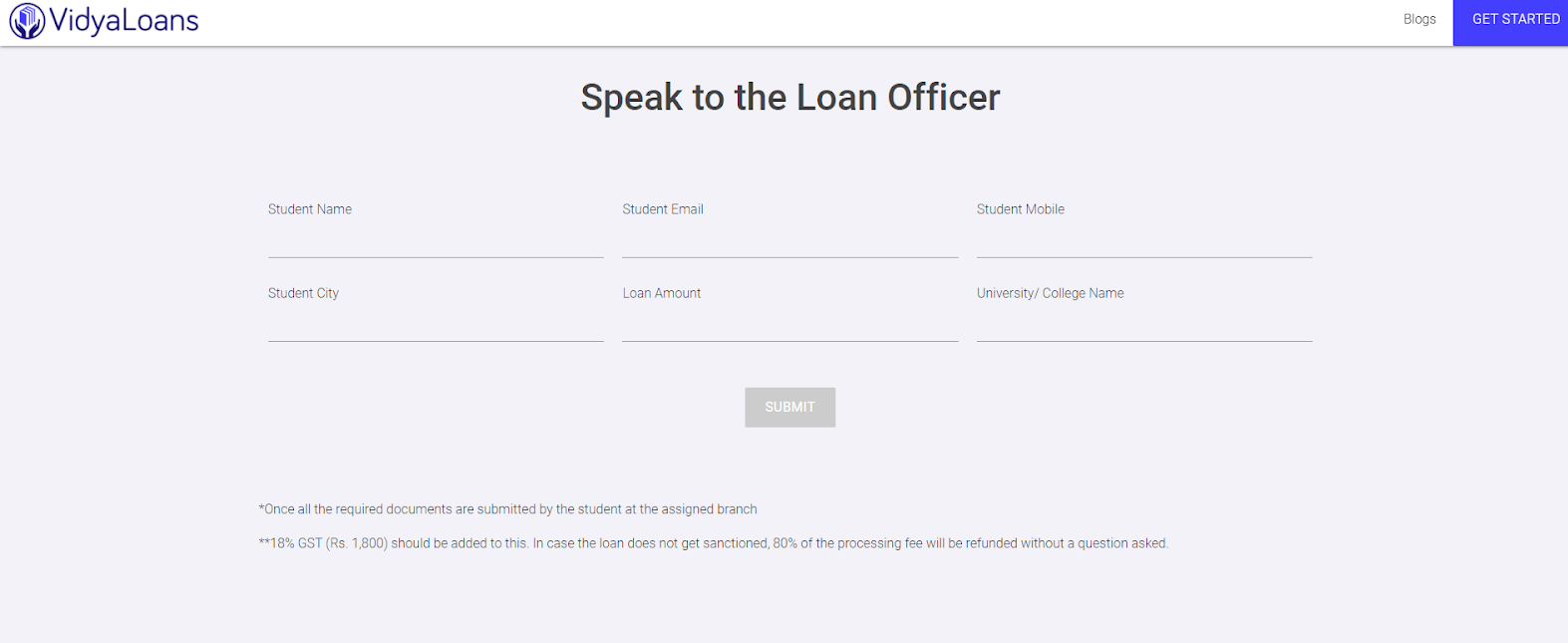

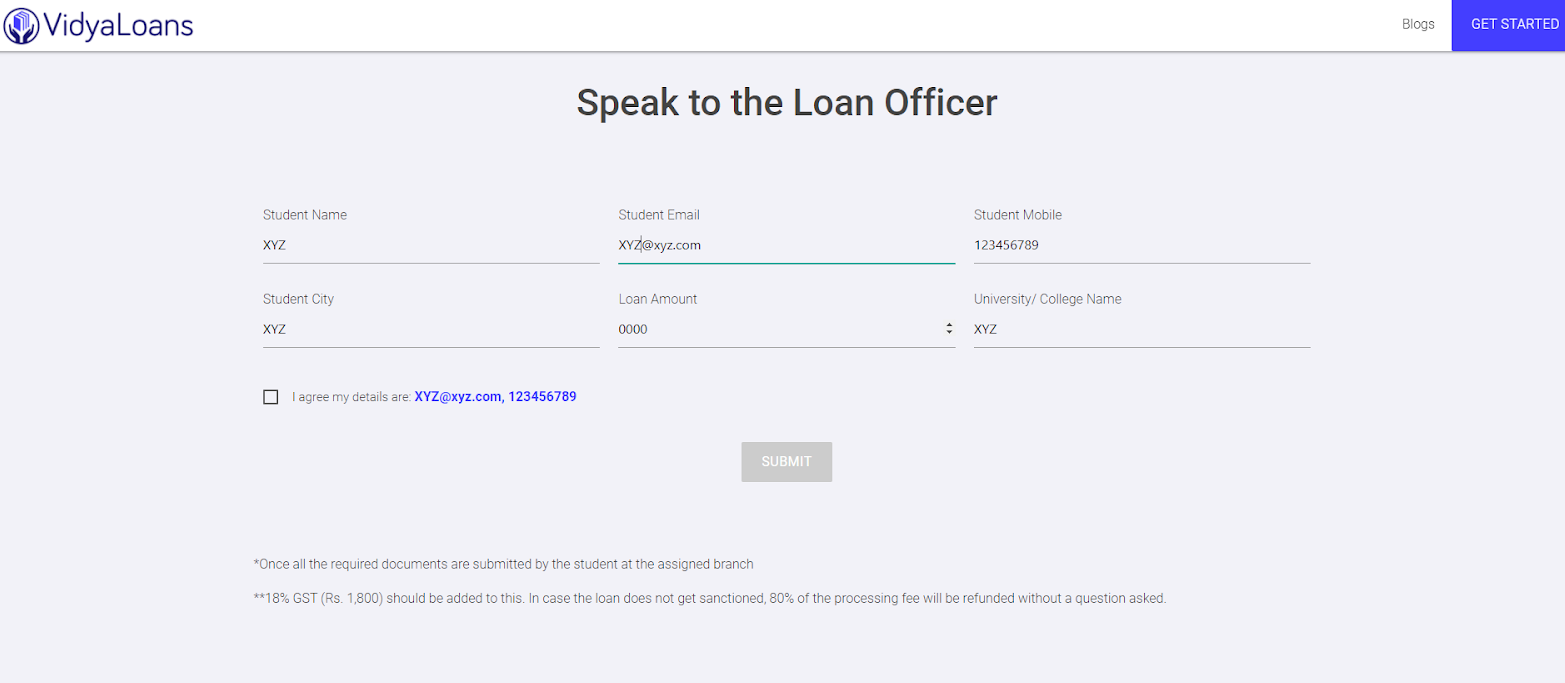

Step 3: Soon as you click on the apply button, it will take you to speak to the loan officer section.

Step 4: Fill in all the required fields.

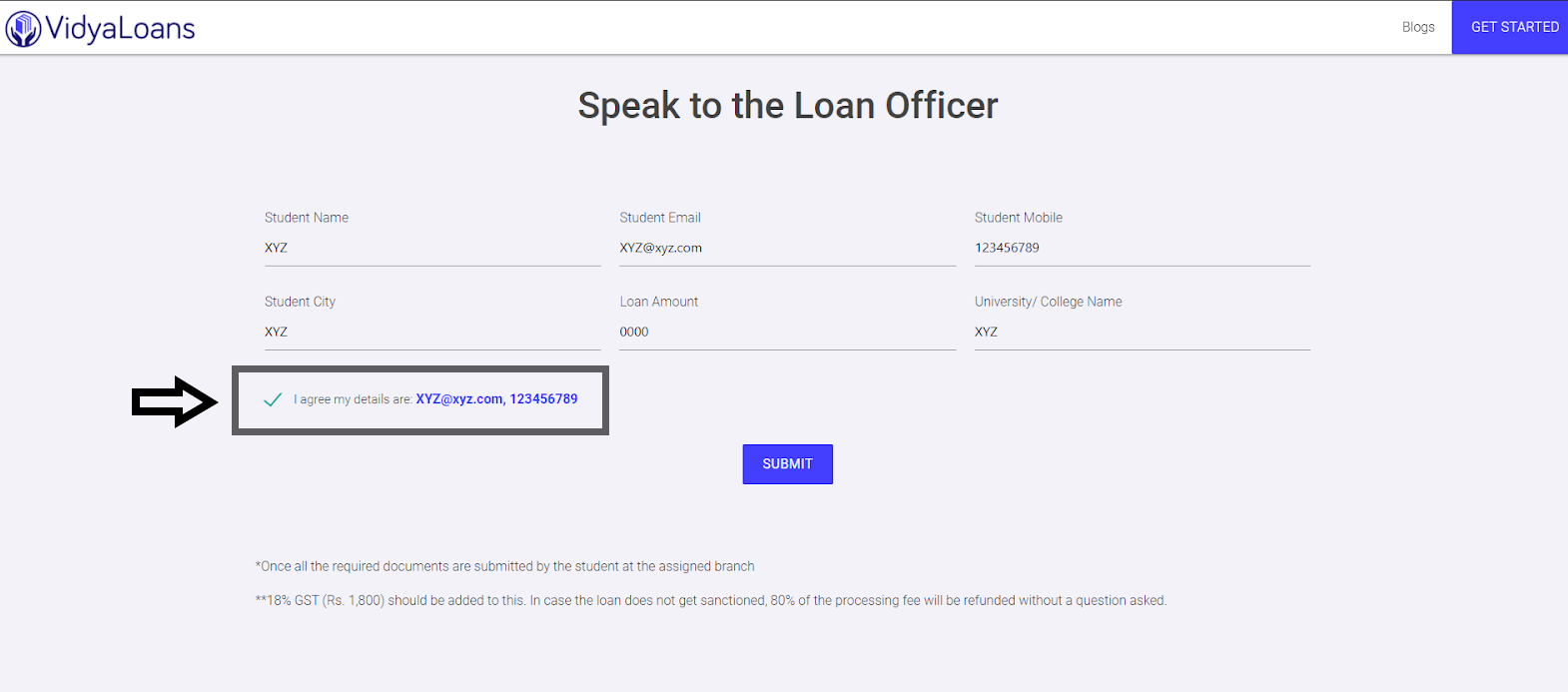

Step 5: When done filling all the required information, click on I agree button

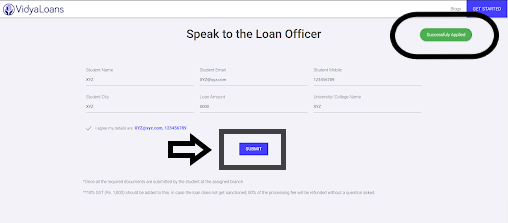

Step 6: Click on submit button to apply for an education loan.

Congratulations!!! You’ve applied for an education loan. Your processing officer from Vidyaloans will connect with you soon.

Note: At VidyaLoans we bridge the gap between the student and the bank. Our team at VidyaLoans has never failed to resolve the issues faced by the students in the required time frame. Our team closely checks with multiple Government banks and keeps a close watch on your loan application status. Vidyaloans will come to your rescue if you are facing any trouble with your education loan process. Connect with our team to know all the available services and experience a hassle-free experience with Vidyaloans.

About the organization-VidyaLoans is an organization which helps Indian students in India to secure a non-collateral loan from Government banks up to 7.5 Lakhs. We have a dedicated team of professionals who assist students with queries and guide them throughout the loan process. Our Team at Vidyaloans is committed to sanction the best loan option suiting the applicant's profile and needs, in a stipulated time frame.